Michigan Sentiment Index expected to improve in December, but remains historically weak

- December’s preliminary Michigan Consumer Sentiment Index is forecast to have picked up to 52 from a three-year low of 51.0 in November

- A stalled labour market and higher price pressures are likely to weigh on consumers’ confidence.

- UoM Consumer Sentiment’s pick up is unlikely to provide significant support to an ailing US Dollar

The United States (US) will see the release of the preliminary estimate of December’s University of Michigan's (UoM) Consumer Sentiment Index on Friday. The report is expected to reflect a moderate improvement in consumers’ confidence, with the UoM Consumer Sentiment Index forecast to bounce to 52 after reaching a three-year low of 51 last month.

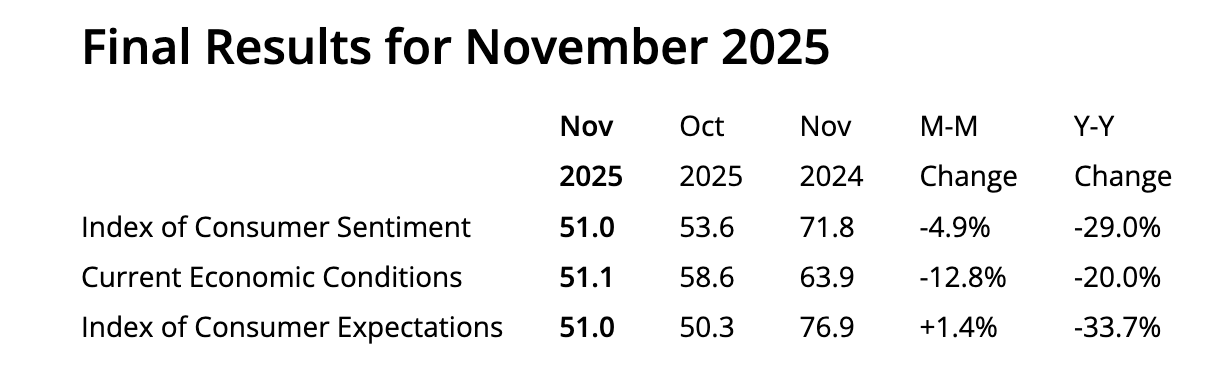

November’s data also revealed a sharp deterioration in consumers’ views about the current economic conditions, with the index dropping to 51.1 from 58.6 in October. The Economic Expectations Index, on the other hand, improved slightly to 51 from 50.3 in October.

The Consumer Sentiment Index is a monthly survey conducted by the UoM that compiles data on US consumers’ views on their personal finances, business conditions, and purchasing plans. The report is disclosed together with the UoM Consumer Expectations Index and the UoM Consumer Inflation Expectations.

Two weeks later, the University of Michigan will release the final Consumer Sentiment Index report.

Household consumption accounts for about two-thirds of the US Gross Domestic Product (GDP). In that sense, the UoM Consumer Sentiment Index is regarded as an accurate forward-looking indicator for US economic trends, and its release tends to have a significant impact on US Dollar (USD) crosses.

December’s release will be the first after a record-long US shutdown, and investors will be eager to see the impact of the government’s reopening, even though the market consensus does not show any relevant improvement.

A stalled labour market and higher prices are likely to remain the biggest concerns for US consumers, keeping the Michigan Consumer Sentiment near historic lows. The 52 expected level would be an improvement from the 51 seen in November, but it marks a nearly 30% decline from the 74 reading seen in December last year.

November’s official report pointed to the increasing prices and lower income as the main reasons for the deterioration in sentiment: “Consumers remain frustrated about the persistence of high prices and weakening incomes. This month, current personal finances and buying conditions for durables both plunged more than 10%, whereas expectations for the future improved modestly,” says the report.

Regarding prices, the moderating inflationary trends have not eased consumers’ frustration: “Despite these improvements in the future trajectory of inflation, consumers continue to report that their personal finances now are weighed down by the present state of high prices.”

When will the UoM Consumer Sentiment Index be released, and how could it affect US Dollar?

The University of Michigan will release its Consumer Sentiment Index, together with the Consumer Inflation Expectations survey, on Friday at 15:00 GMT. The market expects a slight improvement in consumer sentiment, although most likely insufficient to provide a significant impulse to an ailing US Dollar.

The Greenback has been the worst-performing G8 currency in November. Dovish comments from Federal Reserve (Fed) officials, coupled with a batch of weak macroeconomic indicators, namely Retail Sales and Manufacturing activity, have revived fears about the momentum of the US economy and prompted investors to ramp up bets of a Fed interest rate cut in December.

Beyond that, news that White House economic advisor Kevin Hassett is the best positioned to replace Fed Chairman Jerome Powell at the end of his term in May, is fuelling hopes of further monetary policy easing in 2026.

With the rest of the world’s major central banks at the end of their easing cycles, the monetary policy divergence with the US Federal Reserve is crushing the US Dollar.

According to Guillermo Alcala, FX Analyst at FXStreet, the US Dollar Index (DXY) has broken an important support area at 99.00: “The pair has confirmed a double top at the 100.35 area, after breaching the pattern’s neckline, near 99.00, which is holding bulls at the time of writing. Failure to return above that level would increase bearish pressure towards the October 28 low at 98.57 and the October 17 low near 98.00. The double top’s measured target is near the October 1 and 2 lows, around 97.50.”

To the upside, Alcalá sees resistances at 99.55 and in the 100.00 area: “Upside attempts are likely to be challenged at the November 30 and December 2 highs near 99.55 and the 100.00 psychological level, ahead of the five-month highs, in the area of 100.35 (November 5 and 21 highs).”

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Dec 05, 2025 15:00 (Prel)

Frequency: Monthly

Consensus: 52

Previous: 51

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Economic Indicator

Michigan Consumer Expectations Index

The University of Michigan's Inflation Expectations gauge captures how much consumers anticipate prices will change over the coming 12 months. It comes out in two rounds—a preliminary release that tends to pack a bigger punch, followed by a revised update two weeks later.

Read more.Next release: Fri Dec 05, 2025 15:00 (Prel)

Frequency: Monthly

Consensus: -

Previous: 51

Source: University of Michigan