Could Trump name next Fed Chair on Wednesday, overshadowing FOMC meeting?

- Donald Trump could announce on Wednesday the name of the next head of the Federal Reserve, as the monetary policy meeting is taking place.

- Markets are assessing the potential impact of this nomination on rate-cut expectations and on the institution’s independence.

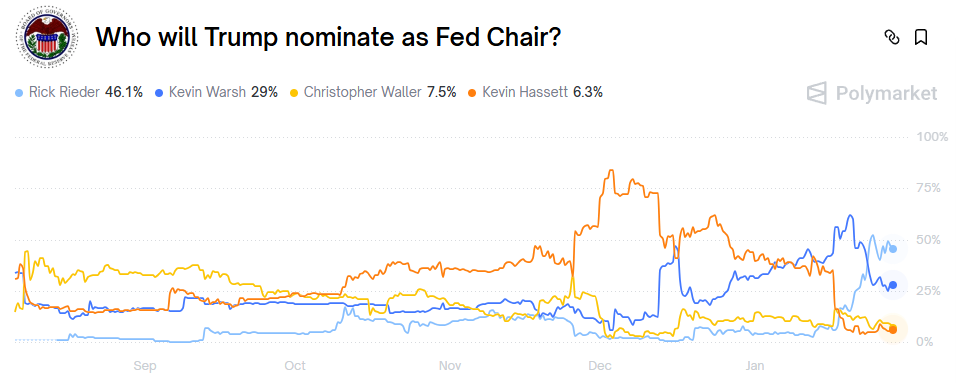

- Rick Rieder is seen as the frontrunner in prediction markets, ahead of Kevin Warsh, Christopher Waller and Kevin Hassett.

Speculation is intensifying over US President Donald Trump’s nomination of the next Chair of the Federal Reserve (Fed), an announcement that could come as early as Wednesday, while the Federal Open Market Committee (FOMC) is also holding its monetary policy meeting.

According to several press reports published in recent weeks, the US president says he has “already” made up his mind about the successor to the current Fed Chair Jerome Powell, whose term ends in May. This sequence adds to uncertainty, as it coincides with a Fed meeting widely expected to result in no change in interest rates, shifting market focus toward the central bank’s communication and the succession issue.

In markets, the race is now led by Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, who is seen as supportive of lower interest rates without being perceived by some investors as a direct threat to the Fed’s independence.

At the time of press, Polymarket odds put him in first place at 46.1%, ahead of former Fed Governor Kevin Warsh at 29%. Christopher Waller, a current member of the Fed’s Board of Governors, is credited with 7.5%, while Kevin Hassett, director of the National Economic Council (NEC), stands at 6.3%.

Beyond the timing, the issue is both political and macroeconomic. Donald Trump repeatedly calls for a more accommodative monetary policy, leading market participants to assess the risk that a choice seen as too closely aligned with the White House could undermine the Fed’s credibility. By contrast, a more “institutional” profile could limit the repricing of an aggressive rate-cut scenario, even though the Fed Chair carries significant influence but does not decide alone, as policy decisions are taken collectively within the FOMC.

In this context, the day could prove binary for expectations: A nomination perceived as strongly supportive of rate cuts could revive bets on earlier and deeper easing, while a choice seen as more independent could refocus attention on economic data and Jerome Powell’s message at the press conference later in the day.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jan 28, 2026 19:00

Frequency: Irregular

Consensus: 3.75%

Previous: 3.75%

Source: Federal Reserve