Trading Brent Versus Crude Oil

October 13, 2021

The energy market provides ample trading opportunities for those willing to engage in it. You hear about energies in the news almost everyday, as it powers just about everything in civilization. West Texas Intermediate (WTI), or what we usually refer to as “crude oil,” is arguably the most liquidly traded commodity in the futures market. But why limit yourself to WTI crude when you also have North Sea Brent (Brent) crude, its European cousin?

Sure, WTI may be more liquid than Brent, but opportunities abound in both. They’re correlated, meaning that they often move together, up or down. But they don’t move in lockstep. There are times when one is more expensive than the other. Might it be a way to diversify longer-term exposure? Might it present an arbitrage opportunity, where you go short one and long the other, until the spread between the two commodities narrows?

Before we get into it, you might want to ask the following:

- What are the similarities between the two, and how are they different?

- Are they affected by the same “global” economic forces?

- How might “local” differences in supply and demand differentiate their prices?

Light and Sweet, or Heavy and Sour?

Terminology hinting of taste or food may seem strange when thinking about crude oil but you should get acquainted with the lingo as it’s often used. Both WTI and Brent are considered “light and sweet.”

It’s more than just a metaphor, there’s actually criteria behind it, and it all pertains to gasoline refinement capacity. Basically, the lighter the density, the easier it is to refine into gasoline. Conversely, the heavier the density, the more difficulties it presents in the refinement process.

If you want to get more detailed about it, the American Petroleum Institute (API) classifies densities by API gravity numbers from 10 to 70. Here’s where it can get confusing: the higher the API gravity number, the lighter the oil density. How light is light? Light oils can float on water while heavier oils tend to sink.

So, what about the term “sweet”? No, it’s not about sugar but rather sulfur. The midpoint in sulfur content is 0.5% Any oil that has more than this is considered sour; anything below it is sweet. Like lighter oils, the sweeter the oil, the easier it is to refine into gasoline or other petroleum products.

So, when it comes to assessing the quality of oil, these two criteria establish the premium benchmarks. It’s also important to recognize how both commodities are recognized worldwide. Brent crude is the “global” benchmark for oil as around two-thirds of the world’s oil prices are based on Brent. WTI is the US benchmark for oil prices. So, overall, locality matters a lot.

Recapping the Differences in a “Drill-Down” Fashion

Where they’re extracted:

- WTI is drilled and extracted from the US, namely Texas, Louisiana, and North Dakota.

- Brent’s extracted from the North Sea (that’s near Europe).

Oil Density:

- WTI’s API gravity is around 39.6°

- Brent’s API gravity is 38° (slightly heavier than WTI).

Sweetness:

- WTI’s sulfur content is 0.24%.

- Brent’s sulfur content is 0.40%.

Both are under the 0.50% benchmark, and while both are “sweet,” Brent is less sweet than WTI.

Transportation:

- WTI is landlocked; transportable via underground pipelines or trucks.

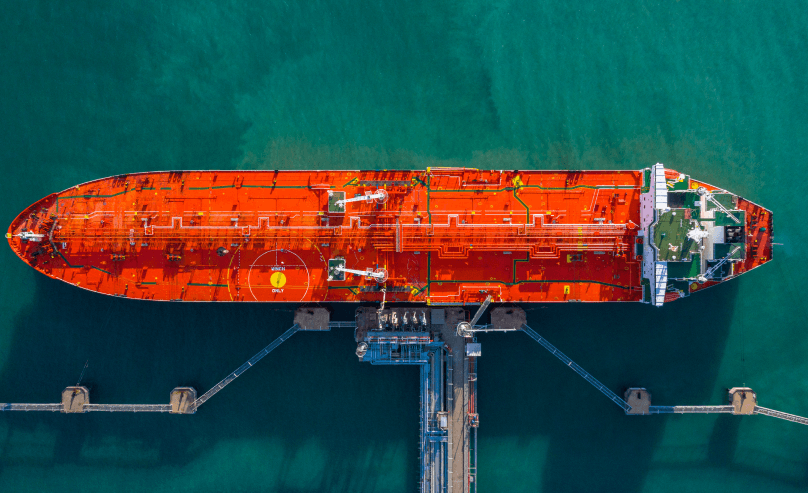

- Brent comes from the sea, making it much easier to transport globally.

Where do their futures trade?

- Both trade on major US and European exchanges.

- WTI trades on the NYMEX which is owned by the CME Group.

- Brent trades on the Intercontinental Exchange (ICE) and the CME.

As you can see, physical quality is just one factor that makes up the overall benchmark. Energy insiders also have to consider location, logistics, and how both play into global supply and demand.

The Role of Geopolitics in Crude Oil Prices

Middle East tensions in 2011 threatened passage through the Suez Canal. Fears of a closure caused Brent prices to soar well past the WTI premium. Making matters worse, Iran threatened it would close the Strait of Hormuz through which 20% of the world’s oil was transported. By the end of the year, Brent was $25 above WTI’s price.

A wide spread between Brent and WTI happened again in 2015 amid events in the US and the Middle East. Iran ramped up oil production, causing Brent prices to fall. In the US, oil export activity increased while its rig count declined, causing WTI prices to soar above its Brent counterpart. This widening in the spread was temporary, and Brent has been trading at a premium above WTI since 2016.

In 2018, Brent’s premium grew to $6 per barrel above WTI due to distribution bottlenecks in the US and competition from Canadian oil producers.

In 2020, Middle East tensions flared once again, as a top Iranian commander had been killed, causing crude oil prices to jump. But prices dropped as Russia and Saudi Arabia became embroiled in an oil price war. Then unexpectedly, the Covid-19 pandemic took place, which caused crude oil prices to plunge even lower.

Energising Industries Worldwide

The takeaway here is that crude oil impacts industries and markets across the globe, and events affecting geopolitics and global industry affect the price of crude oil. So, if you trade crude oil, it’s advisable to monitor this wide landscape of global economics and geopolitics. Also note that although Brent and WTI are correlated in price, each benchmark responds differently to local, geopolitical, and economic forces.